UK Asset Management Market Overview

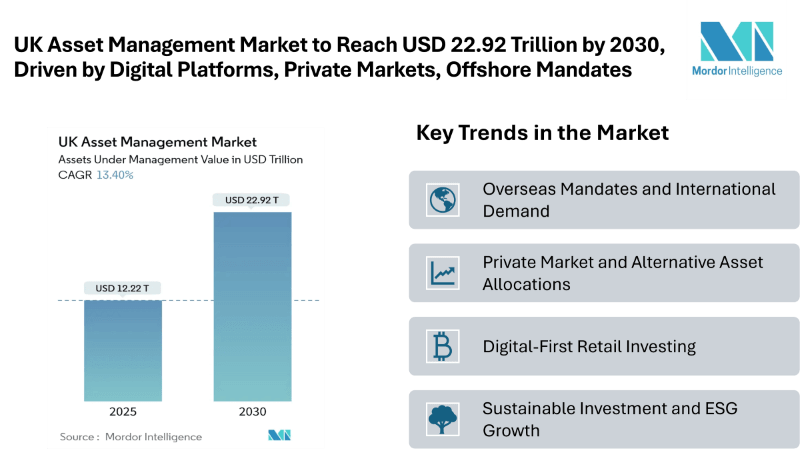

The UK Asset Management Market is projected to grow from USD 12.22 trillion in 2025 to USD 22.92 trillion by 2030, registering a CAGR of 13.40%. This growth underscores the expanding UK asset management market share and reinforces its role as a key pillar of the financial services sector.

This landscape highlights the resilience and adaptability of the UK Asset Management Industry, providing investors and firms with diverse opportunities while sustaining a competitive and dynamic investment environment.

Key Trends in the UK Asset Management Market

- Overseas Mandates and International Demand

International clients now account for nearly half of UK-managed assets, highlighting the global appeal of UK asset managers. The UK serves as a bridge between North America, Asia-Pacific, and the Middle East, offering legal protections, time-zone advantages, and strong governance frameworks.

- Private Market and Alternative Asset Allocations

Institutional investors are steadily increasing allocations to private markets. The Mansion House Compact encourages pension providers to dedicate a portion of defined contribution assets to unlisted equity, infrastructure, and private credit.

- Digital-First Retail Investing

Retail investors are driving growth through digital platforms that offer fractional shares and simplified onboarding. These platforms have lowered entry barriers, particularly for younger demographics, and have encouraged participation in thematic portfolios.

- Sustainable Investment and ESG Growth

ESG-focused and SDR-labelled funds are seeing rapid adoption, with mutual fund assets expected to surpass 50% of UK retail fund assets. Transparent reporting, standardized labels, and outcome-based products allow asset managers to maintain margins while promoting socially responsible investment solutions.

Check out more details and stay updated with the latest industry trends, including the Japanese version for localized insights: https://www.mordorintelligence.com/ja/industry-reports/uk-asset-management-industry?utm_source=emailwire

UK Asset Management Market Segmentation

- By Asset Class:

Equity

Fixed Income

Alternative Assets

Other Asset Classes

- By Firm Type:

Broker-Dealers

Banks

Wealth Advisory Firms

Other Firm Types

- By Mode of Advisory:

Human Advisory

Robo-Advisory

- By Client Type:

Retail

Institutional

- By Management Source:

Offshore

Onshore

Explore Our Full Library of Financial Services and Investment Intelligence Research Reports – https://www.mordorintelligence.com/market-analysis/financial-services-and-investment-intelligence?utm_source=emailwire

Key Players in the UK Asset Management Market

- Legal & General Investment Management: A leading UK asset manager specializing in long-term investment solutions, including pensions, equities, and fixed-income strategies.

- Insight Investment: Focuses on fixed-income, multi-asset, and liability-driven investment solutions for institutional clients.

- Schroders: A global investment manager offering equities, fixed income, alternatives, and multi-asset products for both retail and institutional investors.

- Aviva Investors: Provides active investment management across equities, fixed income, real estate, and multi-asset solutions, catering to institutional and retail clients.

- M&G Investments: Offers a broad range of investment solutions including bonds, equities, and multi-asset funds, with a focus on long-term growth for retail and institutional investors.

Explore more insights on the UK Asset Management Market competitive landscape: https://www.mordorintelligence.com/industry-reports/uk-asset-management-industry/companies?utm_source=emailwire

Conclusion

The UK Asset Management Market is poised for sustained growth through 2030, supported by strong domestic contributions, international investor demand, and a favorable regulatory environment. These factors collectively drive the UK Asset Management Market growth, highlighting the ongoing opportunities for both institutional and retail investors.

As robo-advisory adoption accelerates and offshore mandates expand, asset managers are diversifying revenue sources and enhancing operational efficiency. The UK Asset Management Industry is expected to remain one of the leading financial hubs globally, offering a strong framework for both existing players and new entrants.

Industry Related Reports

European Asset Management Market

The Europe Asset Management Market is projected to grow from USD 36.89 trillion in 2025 to USD 59.12 trillion by 2030, at a CAGR of 9.89% during the forecast period. Growth is driven by increasing institutional investments, rising adoption of ESG-focused funds, and expanding digital platforms that simplify access for retail investors.

US Fixed Income Asset Management Market

The US Fixed Income Asset Management Market is projected to grow at a CAGR of 1.5% during the forecast period. The market is supported by rising demand for low-risk investment options, continued interest from institutional investors, and the adoption of technology-driven portfolio management tools to enhance efficiency and risk assessment.

The Japan Asset Management Market is expected to grow from USD 4.93 trillion in 2025 to USD 9.62 trillion by 2030, at a CAGR of 14.31%. Growth is driven by increasing retail investment through digital platforms, rising allocations to alternative assets, and strong demand from institutional investors seeking diversified, long-term investment opportunities.

About Mordor Intelligence:

Mordor Intelligence is a trusted partner for businesses seeking comprehensive and actionable market intelligence. Our global reach, expert team, and tailored solutions empower organizations and individuals to make informed decisions, navigate complex markets, and achieve their strategic goals.

With a team of over 550 domain experts and on-ground specialists spanning 150+ countries, Mordor Intelligence possesses a unique understanding of the global business landscape. This expertise translates into comprehensive syndicated and custom research reports covering a wide spectrum of industries, including aerospace & defense, agriculture, animal nutrition and wellness, automation, automotive, chemicals & materials, consumer goods & services, electronics, energy & power, financial services, food & beverages, healthcare, hospitality & tourism, information & communications technology, investment opportunities, and logistics.

For any inquiries or to access the full report, please contact:

media@mordorintelligence.com

https://www.mordorintelligence.com/

Mordor Intelligence, 11th Floor, Rajapushpa Summit, Nanakramguda Rd, Financial District, Gachibowli, Hyderabad, Telangana – 500032, India.