Introduction to the Europe Private Equity Market

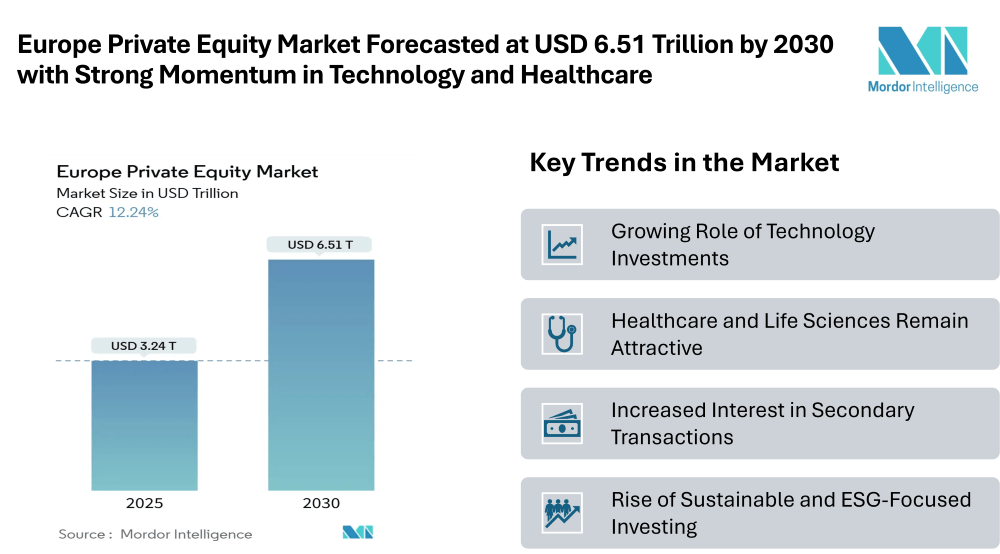

The Europe private equity market size reached USD 3.24 trillion in 2025 and is forecast to climb to USD 6.51 trillion by 2030, delivering a robust CAGR of 12.24% during the forecast period. This growth highlights the increasing appetite for alternative investments across Europe as investors search for higher returns and diversified portfolios. Private equity continues to play a significant role in capital formation, supporting companies across sectors and fueling corporate growth.

According to Europe private equity market report, the demand for private equity is being driven by strong institutional participation, an expanding base of high-net-worth individuals, and a favorable regulatory environment in key European economies. As traditional asset classes face volatility, private equity has emerged as a reliable route for strategic investment. With buyouts, venture capital, and secondaries contributing to the landscape, the region is well-positioned for sustained growth.

Key Trends in the Europe Private Equity Market

Growing Role of Technology Investments

Technology has become one of the dominant sectors within the Europe private equity market. Investors are targeting software firms and digital platforms due to their recurring revenue models, scalability, and resilience during economic cycles. Private equity funds are backing companies that enable digital transformation, cybersecurity, and data-driven services, reflecting Europe’s shift toward a knowledge-driven economy.

Healthcare and Life Sciences Remain Attractive

Healthcare continues to attract consistent private equity capital as demand for medical services, pharmaceuticals, and biotechnology rises. The sector’s long-term growth potential, combined with aging populations and advancements in medical research, makes it an appealing option for both buyout and venture capital investors.

Increased Interest in Secondary Transactions

Secondary deals and fund-of-funds structures are becoming more important in Europe as investors seek liquidity options. These mechanisms allow limited partners to adjust portfolios while enabling general partners to recycle capital into new opportunities. The growing maturity of the European private equity ecosystem is making secondaries a mainstream investment path.

Rise of Sustainable and ESG-Focused Investing

Sustainability is becoming a key driver of private equity investment decisions. Funds are actively incorporating environmental, social, and governance (ESG) metrics into their strategies, particularly in energy, industrials, and consumer sectors. European regulators and investors alike are emphasizing responsible investment practices, boosting the appeal of green and socially conscious portfolios.

Expanding Mid-Market Opportunities

While large-cap deals dominate headlines, there is a significant rise in activity in the upper middle and lower middle markets. Investors are focusing on companies with high growth potential that require capital for international expansion, product diversification, or operational scaling. This trend is creating a balanced ecosystem between mega-deals and small-cap growth investments.

Country-Specific Momentum

The United Kingdom remains one of the most active markets, supported by a strong financial ecosystem, while Germany and France are gaining traction due to industrial and technological strengths. Nordic countries, particularly Sweden, are attracting private equity in renewable energy and services. Southern European markets such as Italy and Spain are also witnessing increased buyout and venture activity, signaling broad regional growth.

Check out more details and stay updated with the latest industry trends, including the Japanese version for localized insights: https://www.mordorintelligence.com/ja/industry-reports/europe-private-equity-market?utm_source=emailwire

Market Segmentation of the Europe Private Equity Market

The Europe private equity market is segmented by fund type, sector, investments, and geography.

By Fund Type

- Buyout & Growth

- Venture Capital

- Mezzanine & Distressed

- Secondaries & Fund of Funds

By Sector

- Technology (Software)

- Healthcare

- Real Estate and Services

- Financial Services

- Industrials

- Consumer & Retail

- Energy & Power

- Media & Entertainment

- Telecom

- Others (Transportation, etc.)

By Investments

- Large Cap

- Upper Middle Market

- Lower Middle Market

- Small & SMID

By Country

- United Kingdom

- Germany

- France

- Sweden

- Italy

- Spain

- Netherlands

- Rest of Europe

This segmentation underlines the diversity of the market, offering multiple routes for investors based on their appetite for risk, scale, and industry preference.

Explore Our Full Library of Financial Services and Investment Intelligence Research Industry Reports: https://www.mordorintelligence.com/market-analysis/financial-services-and-investment-intelligence?utm_source=emailwire

Key Players in the Europe Private Equity Market

The Europe private equity market is supported by a network of established firms with global reach and deep sector expertise.

- Permira Partners: Known for investments across technology, consumer, and industrials, with a strong focus on long-term value creation.

- EQT: Based in Sweden, EQT has built a reputation for its diversified portfolio and growing emphasis on sustainable investments.

- CVC Capital Partners: One of the largest European private equity firms, CVC invests across multiple sectors and has a significant global footprint.

- Apax Partners: With a strong base in Europe, Apax is active in technology, telecom, and healthcare investments.

- Ardian: A French-based firm with a global presence, Ardian manages a broad range of private equity funds, including buyouts, infrastructure, and secondaries.

These firms represent the backbone of the European market, driving deal-making and providing critical capital to businesses across industries. Their ability to leverage networks, expertise, and capital scale continues to shape the future of private equity in the region.

Explore more insights on Europe private equity market competitive landscape: https://www.mordorintelligence.com/industry-reports/europe-private-equity-market/companies?utm_source=emailwire

Conclusion

The Europe private equity market is entering a period of strong growth, underpinned by diverse opportunities across fund types, sectors, and geographies. With an estimated market value of USD 6.51 trillion by 2030, the sector is expected to maintain its momentum, driven by robust investor demand, resilient performance across technology and healthcare, and increasing adoption of ESG principles.

Investors are diversifying strategies through secondaries, mid-market investments, and sector-focused funds, ensuring that capital is allocated across both mature and emerging opportunities. As European economies stabilize and innovation thrives, private equity will remain a cornerstone of corporate financing and economic development.

The ongoing commitment from leading firms such as Permira, EQT, CVC Capital Partners, Apax Partners, and Ardian highlights the sector’s strength and depth. Looking ahead, the Europe private equity market is well-positioned to deliver sustained value to stakeholders while supporting the broader growth trajectory of the region.

For complete market analysis, please visit the Mordor Intelligence page: https://www.mordorintelligence.com/industry-reports/europe-private-equity-market?utm_source=emailwire

Industry Related Reports

US Private Equity Market: United States Private Equity Market is Segmented by Fund Type (Buyout Fund, Growth Equity Funds, and More), Sector (Technology, Healthcare, Consumer and Retail and More), Deal Size ( Small Cap, Mid Cap, Large Cap and Mega Deals), Investor Type (Pension Fund, Investment Company, Funds of Funds, Family Offices and More), Exit Strategy (Trade Sale, IPO and More), and Region.

Get more insights: https://www.mordorintelligence.com/industry-reports/united-states-private-equity-market?utm_source=emailwire

Middle East and Africa Private Equity Market: MEA Private Equity Market is segmented By Industry / Sector (Utilities, Oil & Gas, Financials, Technology, Healthcare, Consumer Goods & Services, and Others), By Investment Type (Venture Capital, Growth, Buyout, and Others), By Country (Saudi Arabia, UAE, Qatar, Kuwait, South Africa, and Rest of the Middle East and Africa).

Get more insights: https://www.mordorintelligence.com/industry-reports/middle-east-and-africa-private-equity-market?utm_source=emailwire

Asia-Pacific Private Equity Market: The Asia-Pacific Private Equity Market is Segmented by Fund Type (Buyout and Growth, Venture Capital, Mezzanine, and More), Sector (Technology, Healthcare, Real Estate, Financial Services, Industrials, Telecom, and More), Investments (Large Cap, Upper-Middle Market, and More), and Country (India, China, Japan, Australia, South Korea and More).

Get more insights: https://www.mordorintelligence.com/industry-reports/asia-pacific-private-equity-market?utm_source=emailwire

About Mordor Intelligence:

Mordor Intelligence is a trusted partner for businesses seeking comprehensive and actionable market intelligence. Our global reach, expert team, and tailored solutions empower organizations and individuals to make informed decisions, navigate complex markets, and achieve their strategic goals.

With a team of over 550 domain experts and on-ground specialists spanning 150+ countries, Mordor Intelligence possesses a unique understanding of the global business landscape. This expertise translates into comprehensive syndicated and custom research reports covering a wide spectrum of industries, including aerospace & defense, agriculture, animal nutrition and wellness, automation, automotive, chemicals & materials, consumer goods & services, electronics, energy & power, financial services, food & beverages, healthcare, hospitality & tourism, information & communications technology, investment opportunities, and logistics.

For any inquiries or to access the full report, please contact:

media@mordorintelligence.com

https://www.mordorintelligence.com/